Introduction

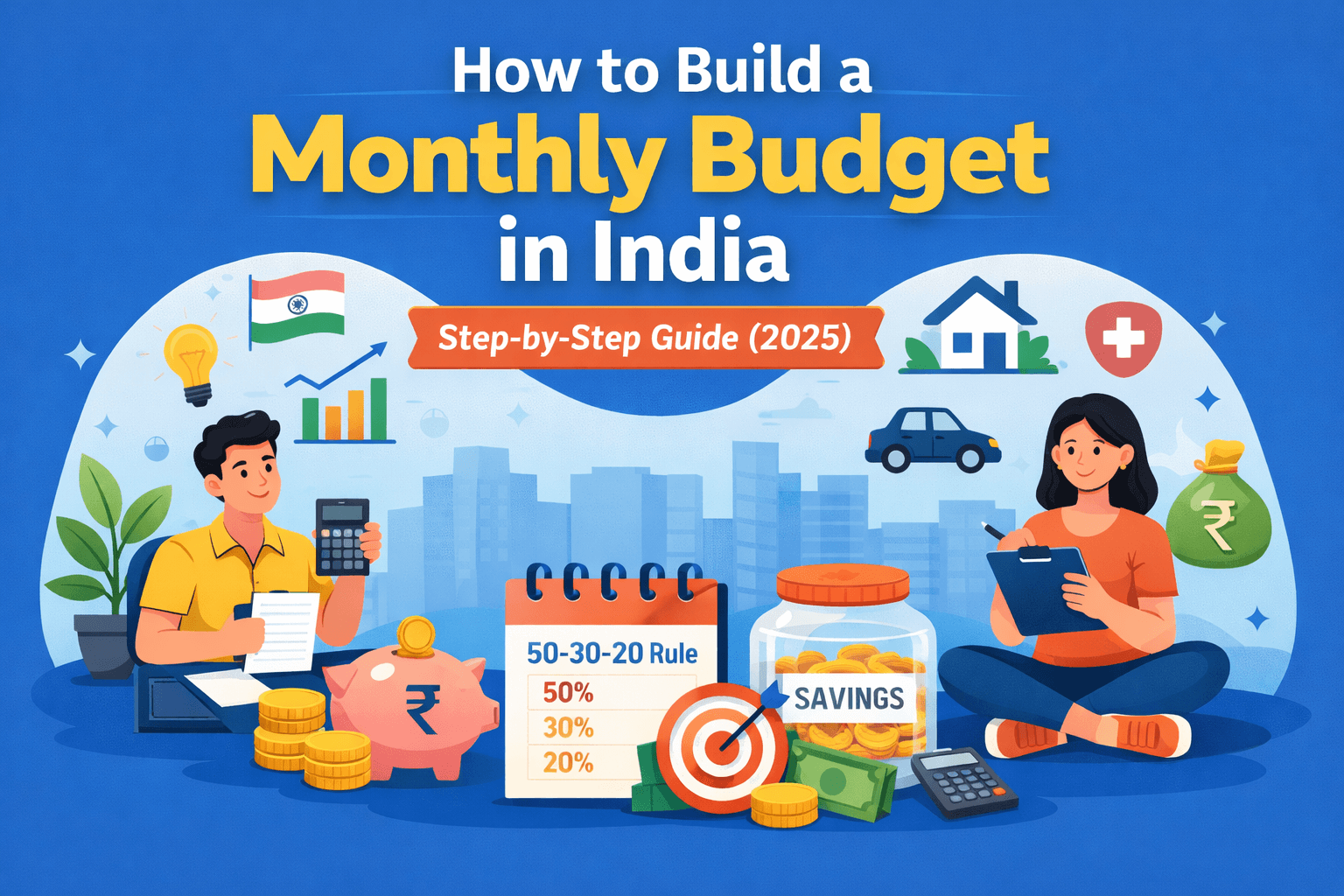

Managing money efficiently Monthly budget in India is one of the most important life skills, yet many people in India struggle with it. Rising expenses, EMIs, lifestyle inflation, and lack of financial planning frequently lead to stress and savings shortfalls. This is where monthly budgeting becomes necessary.

A monthly budget helps you understand where your money comes from, where it goes, and how you can better control it. Whether you are a student, salaried employee, freelancer, or small business owner, budgeting is the foundation of stronger personal finance.

This step-by-step guide will help you build a practical monthly budget in India for 2025, using simple methods, real examples, and novice-friendly explanations.

What Is Monthly Budget in India?

A monthly budget is a financial plan that outlines your income and expenditures for a month. It helps you allocate money for needs, savings, investments, and personal spending in a structured way.

In simple terms, budgeting ensures:

- You spend less than you earn

- You save regularly

- You avoid unnecessary debt

- you achieve financial goals faster

Why Is Monthly Budget in India Important ?

Monthly budgeting is particularly important in India because:

- Income often grows slowly compared to expenditures.

- Medical emergencies can be costly.

- Education and housing costs are increasing

- Many people lack sufficient savings

Advantages of Monthly Budgeting:

- Better control over money

- Reduced financial stress

- Improved saving habits

- Emergency preparedness

- Smarter spending decisions

Step 1: Calculate your monthly income

Start by recognizing your total monthly income.

Includes:

- Salary (after tax)

- Freelance or side income

- Rental Income

- Interest or dividends

Tip: Always use net income (money you actual receive), not gross salary.

Example:

Salary: ₹40,000

Freelance work: ₹5,000

Total Monthly Income=₹45,000

Step 2: Track all your expenses

The next step is to list every expenditure, no matter how small.

Common monthly expenses in India:

- Rent / House EMI

- Groceries

- Electricity, water, gas

- Mobile & internet bills

- Transport / fuel

- Insurance premiums

- Entertainment

- Dining Outside

Track expenditures for at least 30 days using:

- A notebook

- Excel sheet

- Budgeting apps

Step 3: Classification Expenses

Now divide your expenditures into two categories:

Needs (Essential)

- Rent

- Food

- Utilities

- school fees

- Medical expenses

Wants (Non-essential)

- Eating out

- OTT subscriptions

- Shopping

- Travel

- Gadgets

This step helps you identify where you can cut expenses.

Step 4: Select the Right Budgeting Rule

50-30-20 Rule(Most Popular in India)

- 50% Needs

- 30% Wants

- 20% Savings

Example (₹45,000 income):

- Needs: ₹22,500

- Wants: ₹13,500

- Savings: ₹9,000

Other Budgeting Methods:

- 60-30-10 rule (higher expenses)

- Zero-Based Budgeting

- Envelope Budgeting System

Choose a rule that suits your lifestyle and income

STEP 5: Set Savings and Financial Goals

Budgeting without objectives is incomplete.

Short-Term Goals:

- Emergency fund

- Vacation

- Gadgets

Long-Term Goals:

- House purchase

- Children’s education

- Retirement

Ideally, build an emergency fund of 3–6 months’ expenses.

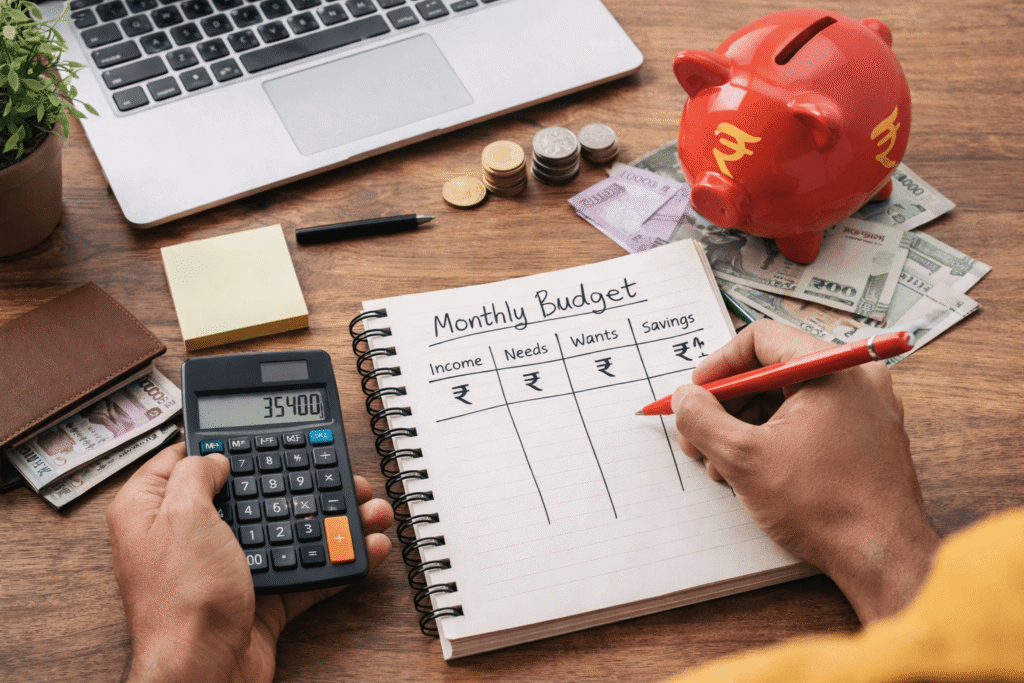

Step 6: Create your monthly budget (example)

Sample Monthly Budget (₹ 30,000 Income):

| Category | Amount (₹) |

|---|---|

| Rent | 8,000 |

| Groceries | 4,000 |

| Utilities | 2,000 |

| Transport | 2,000 |

| Insurance | 1,000 |

| Entertainment | 2,000 |

| Savings | 6,000 |

| Miscellaneous | 3,000 |

This structure gives clarity and control.

Monthly Budget in India for Salaried Employees

- A monthly budget is particularly useful for salaried employees with fixed income.

- Salaried persons should review their monthly budget in India to balance EMIs and savings.

- Creating a monthly budget in India helps paid professionals avoid overspending.

Monthly Budget for Self- Employed and Freelancers

- Irregular income challenge

- Minimum guaranteed savings

- Separate personal & business expenses

- Emergency buffer importance

- For freelancers, a monthly budget in India provides financial stability.

- Managing irregular income requires a flexible monthly budget in India.

- A disciplined monthly budget in India helps self-employed individuals plan taxes better.

Step 7: Adjust and optimize your budget

Budgeting is not fixed. Adjust it when:

- Income changes

- Expenses increase

- New goals arise

Review where you overspend and reduce unnecessary costs slowly.

How Inflation Affects Monthly Budget in India(2025)

Explain:

- Food & fuel inflation

- Rent increase

- Education and healthcare costs

- How to adjust budget annually

- Inflation directly influences a monthly budget in India.

- In 2025, adjusting your monthly budget in India is necessary due to increasing costs.

Step 8: Using Budgeting Tools and Apps

Popular Budgeting Apps in India :

- Walnut

- Money View

- ET Money

- Goodbudget

You can also use Google Sheets or Excel for complete control.

Common Budgeting Errors to Avoid

- Not tracking expenses

- Setting unrealistic savings targets

- Ignoring small daily expenses

- Not budgeting for emergencies

- Giving up after one bad month

tips to stick to your monthly budget

- Automate savings

- Pay yourself first

- Limit credit card usage

- Review weekly

- Reward yourself occasionally

Consistency counts more than perfection.

Monthly Budget for Various Income Levels

₹20,000 Income:

- Focus on essentials

- Minimum 10–15% savings

₹50,000 Income:

- Balanced lifestyle

- 20–30% savings

₹1,00,000+ Income:

- Aggressive savings and investments

- Lifestyle inflation control

How Frequently Should You Review Your Budget?

- Weekly: Expense tracking

- Monthly: Budget adjustment

- Yearly: Goal revision

Regular reviewing keeps your finances healthy.

Frequently Asked Questions(FAQs)

Q1.Is a monthly budget in India essential for beginners?

Yes, a monthly budget in India is essential for beginners to track expenses, save money, and avoid unnecessary debt.

Q2. How much should I save monthly?

Ideally, 20% of income, but even 10% is a good beginning.

Q3. Could budgeting help reduce debt?

Yes. Budgeting helps you assign money for debt repayment.

Q4. Which budgeting rule is best?

50-30-20 rule

Q5. Is a monthly budget in India different for households and individuals?

Yes, a monthly budget in India varies depending on family size, income level, and financial responsibilities.

Q6.Can a monthly budget in India help control inflation effect?

A well-planned monthly budget in India helps adjust spending and maintaining savings despite inflation.

Conclusion

Creating a monthly budget in India is the first step toward financial discipline.

With continuity, a monthly budget in India can help you achieve long-term financial goals.

Start small, stay consistent, and improve slowly. With the correct approach, budgeting can transform your financial future in 2025 and beyond.

Creating a monthly budget in India is the foundation of long-term financial discipline.

With consistency, a monthly budget in India helps individuals attain financial security and peace of mind.

Disclaimer

This article is for educational and informative purposes only. This does not constitute financial advice. Please consult a certified financial advisor before making financial decisions.