Introduction

The State Bank of India (SBI) has revised its term deposit (FD) interest rates and also reduced lending rates in 2025. This move comes at a time when inflation is stabilization and the Reserve Bank of India is focusing on supporting economic growth.

For consumers, this change impacts fixed deposit returns, home loan EMIs, personal loans, and business borrowing costs. In this article, we explain what has changed, why SBI took this decision, and how it will affect depositors and debtors.

SBI FD Interest Rates 2025 – Overview

SBI FD Interest Rates 2025 have been amended by the State Bank of India after the Reserve Bank of India (RBI) announced a repo rate cut. Along with changes in SBI FD Interest Rates 2025, the bank has also decreased its MCLR and EBLR lending rates. The revised fixed deposit interest rates applicable to both senior citizens and the general public across various tenures and are effective from December 15, 2025.

SBI FD Interest Rates 2025 have been revised after the Reserve Bank of India’s six-member Monetary Policy Committee (MPC) voted unanimously to reduce the repo rate by 25 basis points, bringing it down to 5.25% from 5.50%. This policy move has directly affected SBI’s deposit and lending rate structure.

Revised SBI FD Interest Rates 2025

Under the latest revision, the bank has reduced SBI FD interest rates till 2025 for deposits below ₹3 crore with a tenure of two to three years. The interest rate for the general public has been cut from 6.45% to 6.40%, whereas senior citizens will now earn 6.90%, down from 6.95%.

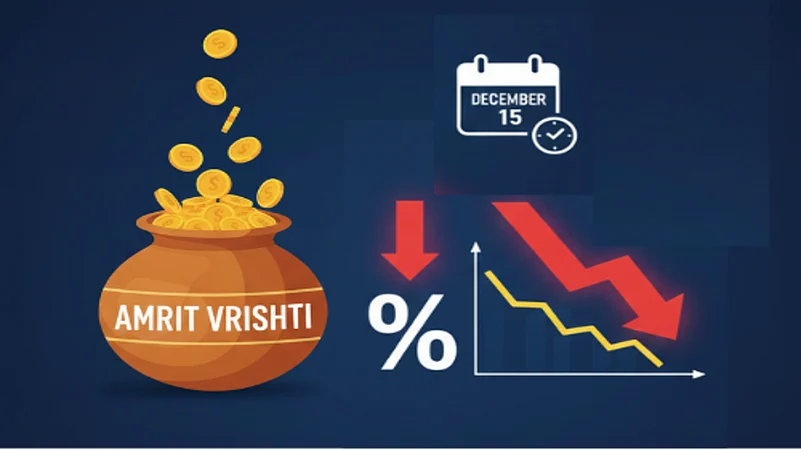

Additionally, the interest rate for SBI’s special fixed deposit scheme Amrit Vrishti (444 days) has also been amended. Under the updated SBI FD interest rates 2025, the rate for this tenure has been decreased from 6.60% to 6.45%, impacting both new and renewing depositors.

Highest SBI FD Interest Rates 2025

The highest SBI FD interest rates 2025 stands at 6.05% for the general public and goes up to 7.05% for senior citizens on deposits of less than ₹3 crore, dependent on the tenure.

General public

Under the latest SBI FD Interest Rates 2025, fixed deposit tenures ranging from 7 to 45 days offer an interest rate of 3.05%, whereas deposits with tenures of 46 to 179 days earn 4.90%. For deposits with a tenure of 180 to 210 days, the interest rate stands at 5.65%, whereas deposits with a tenure of 211 days to less than one year earn 5.90% per year.

Under the updated SBI FD Interest Rates 2025, fixed deposits with a tenure of one year to less than two years offer an interest rate of 6.25%, whereas deposits with a tenure of three years to less than five years earn 6.30% per annum. For long-term deposits varying from 5 to 10 years, depositors can earn 6.05% interest. As per SBI FD Interest Rates 2025, the bank provides multiple fixed deposit options with tenures starting from 7 days up to 10 years, catering to various investment needs.

Senior citizens

Under the amended SBI FD Interest Rates 2025, senior citizens earn higher interest rates depending on the tenure. Fixed deposits with a tenure of 7 to 45 days offer an interest rate of 3.55%, whereas deposits of 46 to 179 days earn 5.40%. For tenures ranging from 180 to 210 days, senior citizens receive 6.15%, whereas deposits with a tenure of 211 days to less than one year offer 6.40% per year.

As per the updated SBI FD Interest Rates 2025, senior citizens can earn 6.75% interest on fixed deposits with a tenure of one year to less than two years, whereas deposits with a tenure of three to five years offer 6.80% per annum. For long-term deposits ranging from 5 to 10 years, senior citizens will receive an interest rate of 7.05%, making SBI fixed deposits an attractive option for retirement-centric investors.

Revised MCLR rates

In addition to term deposit rates, SBI FD Interest Rates 2025 have been revised along with the bank’s Marginal Cost of Funds-based Lending Rate (MCLR), which represents the minimal interest rate charged on loans.

Apart from changes in deposit and lending benchmarks, SBI FD Interest Rates 2025 revisions have coincided with cuts in the bank’s Marginal Cost of Funds-based Lending Rate (MCLR). SBI’s overnight and one-month MCLR rates have been reduced from 7.90% to 7.85%, while the three-month MCLR has been lower from 8.30% to 8.25%.

The six-month MCLR now stood at 8.60%, down from 8.65%. Additionally, the one-year and two-year MCLR rates have been amended to 8.70% from 8.75%, and the three-year MCLR has been cut from 8.85% to 8.80%.

Revised EBLR rate

Along with revisions in deposit and lending rates, SBI FD Interest Rates 2025 updates have also coincided with a reduction in the bank’s External Benchmade Linked Rate (EBLR). SBI has lowered the EBLR from 8.15% to 7.90%, effective December 15. The EBLR is linked to floating interest rates on loans and is typically benchmarked to external rates such as the Reserve Bank of India’s (RBI) repo rate, directly influencing borrowers with repo-linked loans.

With the latest round of reduction, SBI FD Interest Rates 2025 updates have coincided with a 25 basis point cut in the External Benchmade Linked Rate (EBLR), bringing SBI’s EBLR down to 7.90%.

The revised rates will come into effect from December 15, 2025, SBI said in a statement.

The rate reduction is in reaction to last week’s RBI’s decision to slash the key interest rate by 25 basis points for the fourth time this year to support growth.

The bank has also slashed the Marginal Cost of Funds-Based Lending Rate (MCLR ) across all tenures by 5 basis points. With the modification, the one-year maturity MCLR will fall to 8.70% from the existing 8.75%.

Likewise, a one-year maturity rate will be cheaper by 5 per cent to 8.75% and 8.80%, respectively, it said.

The bank has reduced the Base Rate/BPLR to 9.90% from the existing 10%, effective from December 15, it said.

Besides, the bank also decided to cut the fixed deposit rate by 5 base points for maturity two years to less than three years to 6.40% effective December 15.

However, the bank has retained interest rates on other maturity buckets, signaling pressure on deposit mobilisation.

Apart from changes in deposit and lending benchmarks, SBI FD Interest Rates 2025 updates have coincided with a reduction in the bank’s External Benchmark Lending Rate (EBLR). The State Bank of India has cut its Repo Linked Lending Rate (RLLR) by 25 basis points, from 8.35% to 8.10%, thereby completely passing on the policy rate cut to customers, the bank said in a statement.

In line with the wider rate revisions, SBI FD Interest Rates 2025 updates have also been accompanied by lending rate cuts, as the bank’s Asset Liability Management Committee (ALCO) approved a 5-basis-point reduction in the Marginal Cost of Funds-Based Lending Rate (MCLR) across tenors ranging from three months to three years.

These revisions will lower Equated Monthly Installments (EMIs) for both existing and new borrowers whose loans are tied to these benchmarks, it said.

Along with the revision in SBI FD Interest Rates 2025, retail customers seeking home, vehicle, and personal loans are expected to benefit from improved affordableness due to lower lending rates. MSMEs and corporate borrowers will also see a reduction in their cost of funds, which is likely to ease working capital needs and support overall business growth, the bank added.

Latest SBI FD interest rates 2025

| Tenure | General Public (% p.a.) | Senior Citizens (% p.a.) |

|---|---|---|

| 7 days to 45 days | 3.05% | 3.55% |

| 46 to 179 days | 4.90% | 5.40% |

| 180 to 210 days | 5.65% | 6.15% |

| 211 days to <1 year | 5.90% | 6.40% |

| 1 year to <2 years | 6.25% | 6.75% |

| 2 years to <3 years | 6.45% | 6.95% |

| 3 years to <5 years | 6.30% | 6.80% |

| 5 years up to 10 years | 6.05% | 7.05% |

| 444 Days (Amrit Vrishti) | 6.60% | 7.10% |

Points

- SBI FD rates presently range roughly from ~3.05% to ~6.60% p.a. for regular customers and ~3.55% to ~7.10% P.A. for senior citizens (including special rates such as Amrit Vristhi).

- Rates depend on tenure and client category; senior citizens earn extra interest compared to the general public.

- Special FDs like Amrit Vrishti (444 days) offer higher returns.

Recent Trend (Dec 2025)

Following the RBI’s policy rate cuts, SBI FD Interest Rates 2025 have been reduced on selected tenures, effective from December 15, 2025. As part of this revision, the 444-day fixed deposit scheme witnessed a rate adjustment, with interest rates revised to around 6.5%–6.6% for regular customers, dependent on the deposit category.

Conclusion

SBI’s decision to revised term deposit rates and cut lending rates in 2025 is a balanced move aimed at boosting credit growth while managing deposit costs.

Borrowers are likely to profit from lower EMIs and cheaper loans.

FD investors, particularly senior citizens, may see slightly lower returns on new deposits.

Overall, this shift supports economic activity and encourages spending and investment. Customers should review their financial plans and choose loan or deposit options based on their objectives and risk appetite.

FAQ Scheme (Use this in FAQ section)

1. What is the latest SBI FD interest rates in 2025?

SBI FD interest rates in 2025 range from around 3.05% to 6.60% per year for the general public and up to 7.10% for senior citizens, depending on tenure.

2. Does SBI offers higher FD rates for senior citizens?

Yes, SBI offers an extra interest of up to 0.50% per annum for senior citizens over regular FD rates.

3. What is SBI’s special FD scheme in 2025?

SBI’s special FD scheme like Amrit Vrishti (444 days) offers higher interest rates compared to standard FD tenures.

4. Are SBI FD interest rates revised regularly?

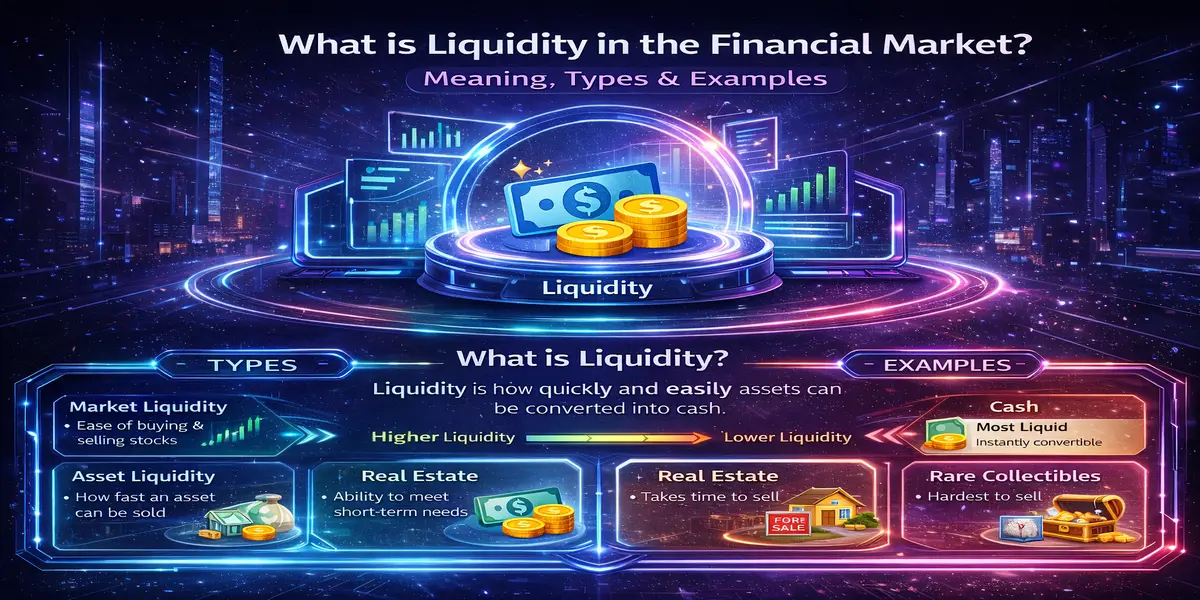

Yes, SBI revises FD rates periodic based on RBI policy decisions, liquidity, and market conditions.

5. Is SBI FD safe for investing?

Yes, SBI FDs are considered very safe as SBI is a government-supported public sector bank in India.

Disclaimer : This article is for informative purposes only. Interest rates, deposit schemes, and loan terms are subject to change as per State Bank of India policies and RBI guidelines. Readers are advised to visit the official SBI website or consultation a bank representative before making any financial or investment decisions.

For more such information, join us atwww.stockhubnews.com